News

New Report: Walmart Uses a Secret Web of Subsidiaries in Tax Havens Allowing them to Dodge Taxes Around the Globe

This week, the US-based tax policy group, Americans for Tax Fairness, released a new report entitled The Walmart Web: How the World’s Biggest Corporation Secretly Uses Tax Havens to Dodge Taxes. The report details, for the first time ever, how Walmart, the world’s largest corporation uses an extensive and secretive web of subsidiaries in tax havens allowing them to dodge taxes around the globe. To mark the report’s release, tax justice campaigners have declared today “Walmart Wednesday” of the Global Week of Action for #Tax Justice.

“We have known for a long time that Walmart’s low-road business model keeps many of its own workers in poverty and encourages abuses throughout the company’s global supply chain,” said Alke Boessiger, UNI Head of Commerce. “Now we know that Walmart’s low-road business model includes the extensive use of tax havens to avoid paying its fair share of taxes all over the world.”

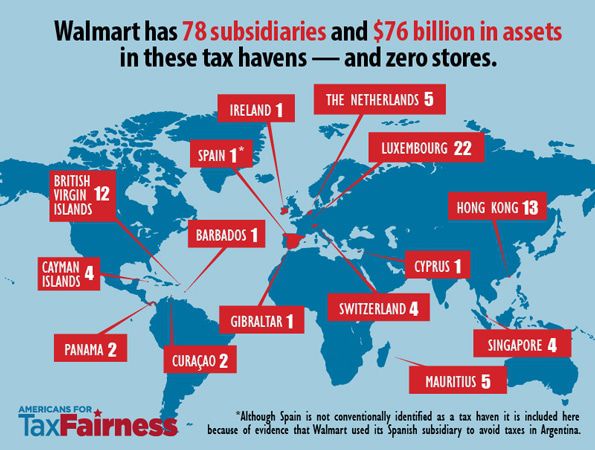

The report found that Walmart has placed $76 billion in assets in shell companies located in 15 tax havens around the world where the company has no stores and few employees. The report also found that Walmart’s tax-haven activities appear to have expanded significantly over the last five years, particularly in Luxembourg. Although Walmart does not have a single store in Luxembourg, it has 22 shell companies there, 20 of which have been established since 2009 and five of which were registered in 2015 alone.

“This is an important and deeply disturbing report,” said Rebecca Wilkins, Executive Director of Tax Justice Network USA and a member of the Global Alliance for Tax Justice Coordination Committee. “Walmart makes billions in annual profits and is owned by one of the world’s richest families, yet they appear to be doing all they can to avoid paying their fair share of taxes through a series of elaborate and previously secret tax maneuvers—at the expense of low- and middle-income citizens around the world.”

Although Walmart’s business practices have a profound impact on every corner of the global economy, the company keeps this most basic information effectively hidden from public view.

Nancy Reynolds, a Walmart cashier for 7. 5 years at Store 0771 in in Merritt Island, Florida, said, “Walmart’s tax havens are making one of the richest families in the world even richer while Walmart workers continue to struggle to get by on poverty-level wages. It’s time for Walmart and the billionaire Waltons to pay their fair share – both by implementing a $15/hour minimum wage in the U.S., and committing to pay their fair share of taxes all around the world.”

Key findings in the report include:

- Walmart has placed at least $76 billion worth of assets in 78 subsidiaries and branches located in 15 overseas tax havens.

- Walmart’s subsidiaries in tax havens have remained largely invisible to even the most knowledgeable experts on corporate tax avoidance.

- Most, if not all, of Walmart’s foreign operating companies are owned through subsidiaries in tax havens. In 25 out of 27 foreign countries where Walmart has stores and a significant number of employees the company owns these retail operations through shell companies domiciled in tax havens.

- The countries in which Walmart’s International operating companies are owned by tax-haven based subsidiaries include: Africa (360 stores in South Africa, plus 36 stores in Botswana, Ghana, Lesotho, Malawi, Mozambique, Namibia, Nigeria, Swaziland, Tanzania, Uganda and Zambia), Brazil (557 stores), Central America (690 stores in Costa Rica, El Salvador, Guatemala, Honduras and Nicaragua), Chile (404 stores), China (411 stores), Japan (430 stores), and the United Kingdom (592 stores). In Argentina, Walmart is owned through a Spanish subsidiary, which helped to company avoid taxes under the terms of the former Argentina-Spanish double tax treaty.

Luxembourg is the center of Walmart’s web of subsidiaries in tax havens

Luxembourg, dubbed a “magical fairyland” by one tax expert because of its ability to shelter profits from taxation, has become the tax haven of choice for multinational corporations in recent years, including Walmart.

Walmart has transferred ownership of more than $45 billion in assets to its 22 Luxembourg subsidiaries since 2011, including operating companies in Brazil, Japan, Puerto Rico and South Africa. From 2010 through 2013, Walmart’s Luxembourg subsidiaries reported paying less than 1 percent in tax to Luxembourg on $1.3 billion in profits.

Walmart’s international operations have been thoroughly integrated into its web of subsidiaries in tax havens

In recent years, Walmart has made subsidiaries in tax havens central to its growing International division, which now accounts for about one-third of the company’s annual profits. Most, if not all, of Walmart’s foreign operating companies are owned through subsidiaries in tax havens. In 25 out of 27 foreign countries where Walmart has stores and a significant number of employees the company owns these retail operations through shell companies domiciled in tax havens.

Walmart owns $76.6 billion in assets through shell companies domiciled in tax havens Luxembourg and the Netherlands. This is equivalent to 90 percent of the assets in Walmart’s International division ($85.2 billion) or 37 percent of the company’s total assets ($204.7 billion).

Walmart’s expanded use of tax haven subsidiaries facilitates tax avoidance

There is evidence that Walmart uses its subsidiaries in tax havens to pursue well-known international tax avoidance strategies that rely on hybrid financial instruments and complex inter-company debt arrangements.

During the first half of 2014, Walmart took $2.3 billion in low-interest, short-term loans from subsidiaries in tax havens, thereby providing Walmart affiliates in the United States access to foreign earnings without paying U.S. tax.

U.S. and international authorities should investigate Walmart’s tax avoidance and act to reign in such tax dodging by all multinational corporations

The findings in this report suggest multiple lines of inquiry with Walmart and reforms that ought to be pursued by the appropriate regulatory authorities and policymakers around the world.

Policymakers in the United States and abroad should press Walmart for accurate and complete country-by-country information on its income and taxes paid, assets, number of employees and more, including for their subsidiaries, to determine whether Walmart has been playing one country off another to escape paying taxes in multiple jurisdictions.

The Organization for Economic Cooperation and Development should use the Walmartexample to test the usefulness of its nascent template for country-by-country reporting of each corporate entity’s income and taxes, and reconsider the decision to give control over the release of those templates to home countries like Luxembourg that might find releasing the information to be embarrassing or worse.

The European Commission should examine Luxembourg and Walmart’s presence there to determine whether Luxembourg has been providing Walmart with sweetheart tax deals equivalent to illegal state aid, thereby engaging in unfair competition against Luxembourg’s European neighbors.

The U.S. Securities and Exchange Commission should ask Walmart for and Walmart should make public a complete list of all of the business entities in its undisclosed network of subsidiaries in tax havens, as well as a record of the ownership of each of those entities and their relationships to the rest of the Walmart group of companies, including Wal-Mart Stores Inc. here in the United States.

Links

Americans for Tax Fairness report: http://www.americansfortaxfairness.org/walmart-tax-havens

Global Week of Action for #TaxJustice: http://www.globaltaxjustice.org/globalweekactiontaxjustice/

For social media, use the hashtags: #WalmartTaxHavens and #TaxJustice

For additional information on Walmart and the Walton family

Making Change at Walmart: http://makingchangeatwalmart.org/

TheWalmart1Percent: http://walmart1percent.org/

Source: Americans for Tax Fairness, “The Walmart Web: How the World’s Biggest Corporation Secretly uses Tax Havens to Dodge Taxes” (June 2015). http://www.americansfortaxfairness.org/walmart-tax-havens