Bank workers, NELP to brief members of Congress on big banks' predatory retail tactics and abusive sales metric

New Report Documents Expansion of Predatory Practices at Big Banks Nationwide

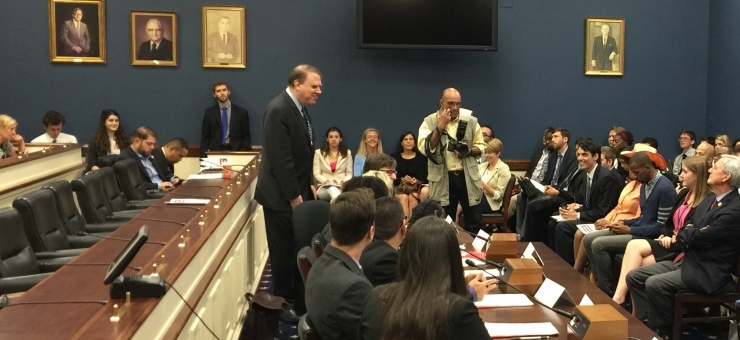

WASHINGTON – Big banks bailed out by U.S. taxpayers continue to aggressively push high interest credit cards and other unnecessary financial products on customers, according to a new report by the National Employment Law Project (NELP). Analysis of industry data, class action lawsuits and interviews with dozens of frontline bank workers reveal the unscrupulous tactics that Wells Fargo and other major U.S. banks are using to force predatory products onto customers. On Friday, frontline bank workers affiliated with the Committee for Better Banks and experts from NELP will brief Rep. Keith Ellison (D-MN) and other members of Congress on the need to protect consumers and workers by crafting new regulations that cease predatory banking practices and aggressive sales metrics systems.

“Eight years after the financial crash, Wall Street CEOs and shareholders are filling their personal bank accounts with earnings from immoral and exploitive bank sales quota systems,” said Anastasia Christman, Deputy Program Director at NELP and author of the report. “Big banks are using frontline workers to pull the wool over ordinary consumers’ eyes. Americans trust bank tellers, but these individuals face the impossible choice of pushing high interest credit cards and other predatory ‘products’ just to keep their jobs.”

The report, Banking on the Hard Sell, finds that in the past six years, consumer complaints to the Consumer Financial Protection Bureau concerning retail banking have risen—in the past year alone complaints increased by 34 percent. Banks continue to reap the rewards from predatory retail tactics: Wells Fargo derived over a quarter of its revenue from predatory fees last year, and the average bank CEO takes home around 455 times the average American worker’s salary. The report finds that low-paid bank workers are ultimately the ones who must directly grapple with the reckless demands of these executives, as predatory incentive programs force them to choose between the consumer’s best interests and earning a living wage.

With low-wage bank tellers and managers operating under hostile work conditions and threats of losing their jobs if they don’t sell these problematic products, bank workers are mobilizing across dozens of states including Massachusetts, California, Texas, Missouri, Rhode Island, Minnesota and Florida through the Committee for Better Banks. The Committee for Better Banks brings together bank workers, consumers and advocates to end the high pressure sales goals that lead to predatory banking practices. Members include Make the Road New York, New York Communities for Change (NYCC), Minnesotans for Fair Economy, New Jersey Communities United, Jobs with Justice and local affiliates, the Communications Workers of America union (CWA) and UNI Global Union.

“When I came to the United States as a refugee, I was excited to find what I thought was a good job at a major bank, but the pressures we face keep me up at night,” said Khalid Taha, a Wells Fargo Personal Banker from San Diego and a member of the Committee for Better Banks. “If Wells Fargo is serious about serving customers, then it should listen to us — the professional customer service representatives on the frontlines. I want to help customers without worrying that I’ll lose my job if I don’t sell an insane amount of credit cards and loans.”

The new report details how America’s biggest banks continue to view workers and customers as “sales machines.” One Bank of America worker recalled a meeting when a co-worker explained why he didn’t push a new product onto his customer, noting: “He said the account was overdrawn and the customer said she was out of work and had just lost her job. The manager told the worker that they should have offered a credit card because it’s not our responsibility for them to pay the bill, just to make the sale.”

NELP and frontline bank workers had present key findings from the report at the Congressional briefing today including:

· Consumer complaints to CFPB are rising: In the last six years, the number of complaints to the Consumer Financial Protection Bureau concerning “Bank Account or Services” and “Debt Collection” continues to rise. Between 2014-2015 and 2015-2016, complaints to CFPB rose 34 percent.

· Predatory fees remain significant source of revenue for banks: Fees and services charges on deposit accounts, credit cards and other products accounted more than a quarter of Wells Fargo’s revenue last year. Americans spent $32 billion on bank overdraft fees in 2013 alone.

· Workers suffer under abusive sales metrics: Big banks’ reckless and predatory sales quota system robs the 1.7 million Americans working in retail banking of basic economic security. Bank workers’ wages have been dropping since the 1970s, and nearly one in three are paid less than $15/hr.

· Big banks are reaping the rewards: The average bank CEO takes home approximately 455 times the average American worker’s salary, and record profits continue to grow backed by customers’ unnecessary credits cards, multiple accounts and complicated financial tools with their own sets of fees and requirements.

NELP’s investigation also found that many workers have no viable avenue to report unethical or illegal sales tactics in the U.S. While many workers say they enjoy helping people in a customer service role, these functions often have to take a back seat to selling various banking “solutions” to earn critical incentive pay. In the European Union, Brazil and other countries workers and banking leaders have partnered to protect customers and improve working conditions.

News released by CWA