CFPB orders Santander Bank to pay $10 Million fine for illegal overdraft practice

Santander received a $10 million penalty on Thursday, with the Consumer Financial Protection Bureau ruling Santander Bank, for its misconduct on sales practice.

Accordingly their Press Release, the Bureau found that Santander marketed its overdraft service deceptively during telemarketing calls and enrolled consumers in overdraft service without their consent in violation of the opt-in rule. For example, during numerous telemarketing calls, call representatives did not ask the consumers if they wanted to opt in but enrolled them anyway. The Bureau found Santander Bank’s illegal and improper practices included:

Signing consumers up for overdraft service without their consent: Enrolled consumers without their consent, even when they said they did not want to enroll but requested information about the overdraft service, When Santander charged those consumers overdraft fees on ATM and one-time debit card transactions, it violated the opt-in rule.

Deceiving consumers that overdraft service was free: Led consumers to believe that Account Protector was free, when in fact it could potentially cost them hundreds of dollars in fees. Bank falsely suggested that consumers would not be charged a fee if they brought their account current within five business days of an overdraft or it would be charged fees only for emergency transactions, and that non-emergency purchases would not result in fees.

Deceiving consumers about the fees they would face if they did not opt in: Consumers has been told that the bank would charge overdraft fees on ATM and one-time debit card transactions regardless of whether they signed up for Account Protector. In fact, Santander could not charge those fees without the consumer’s consent. The also get the information that they risked being charged additional fees if they did not sign up for Account Protector, when in fact the opposite was true.

Falsely claiming the call was not a sales pitch: Bank falsely told consumers that “this is not a sales call” and that the reason for the call was that the bank had recently changed its name. In fact, the purpose of the call was to sell Account Protector, and Santander’s name change was irrelevant.

Failing to stop its telemarketer’s deceptive tactics: Santander offered the telemarketer financial incentives to hit certain sales targets. Santander then failed to identify and stop the deceptive and other improper tactics that its telemarketer used to achieve those sales targets.

As an Enforcement Action Santander US was order to Validate all opt-ins associated with the telemarketer, including to contact all costumer and get their yes to these products, not Use a vendor to overdraft service internalizing the service, Increase oversight of all third-party telemarketers: defining a new policy governing vendor management for service providers engaged in telemarketing of consumer financial products or services and pay a $10 million penalty.

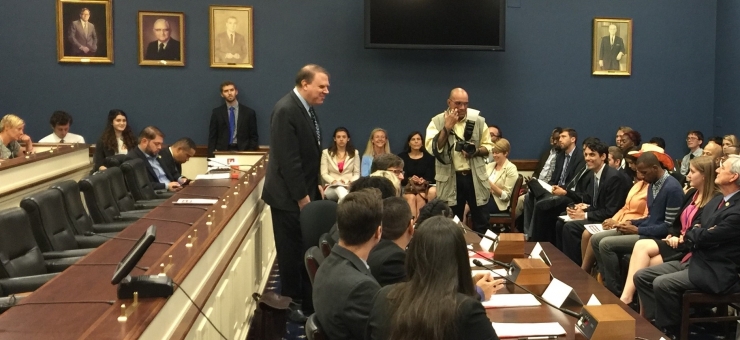

Last month, Committe for Better Banks, presented a report produced by NALC in a hearing at US congress. Bank Teller briefed Congress member about abusive sales practices that continues happen at financial Industry, inclufing the ones found at Santander.

“It is time for Santander to lead the example and get unions to the table to discuss workers condition including Sales Practices. In Europe Santander already signed with unions a joint declaration regarding a labor relation for the provision of Finance Services” Said Rita Berlofa, President of UNI Finance. “It is a great opportunity to help bank to recovery their credibility and clear the right choice to take”.