MENU

Affiliates only

Login

Login

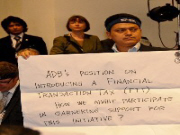

UNI Apro supports the call of PSI AP in their campaign for International Solidarity Levy.

An International Solidarity Levy (ISL) is a global tax that aims to realize a fair global society. A global tax is a cutting-edge instrument to democratize global governance and help address the root causes of current global problems. It is a system of taxation that globally imposes taxes on global goods and activities, with the intent to reduce the negative impacts of the global activities. A global tax raisesthe amount of revenue, redistributes the revenue for the purpose of both providing and realizing global public goods. An ISL aims to re-distribute worldwide wealth, regulate financial speculation and democratize international organizations.

UNI Apro welcomes and supports the promotion and adoption of the Financial Transaction Tax (FTT) as in the model voted by the EU Parliament for strengthening the international financial regulatory framework and to avoid capital flight would significantly curb speculation and limit banks’ excessive reliance on unstable sources of funding. Both of these measures would ensure a fairer burden sharing for the cost of the crisis and raise additional resources that are particularly needed in times of global economic downturn and a source of funding for IFIs and developing member states to achieve the MDGs by 2015 where only 5% of the region’s population are covered by some forms of social protection. Financial development and financial markets therefore must serve the interests of citizens.

A bulletin produced by the International Solidarity Levy Network is attached under related files above.